Protect Your Finances: Unmasking Bank of Scotland Scams in the UK

Introduction:

Banking scams have become an unfortunate reality in our digital age, and it is crucial that we stay informed to safeguard our hard-earned money. In this blog post, we will explore the scams that commonly target customers of the Bank of Scotland in the UK. By sharing real people’s stories, providing examples, and offering helpful tips and tricks, we aim to arm you with the knowledge necessary to detect and avoid these scams.

1. The Curious Case of Miss Johnson:

Picture this: Miss Johnson, a Bank of Scotland customer, was puzzled when she received a phone call seemingly from her bank. The caller, claiming to be a bank representative, informed her that there were suspicious activities on her account and persuaded her to provide personal details. However, what Miss Johnson didn’t realize was that she had fallen victim to a classic phishing scam.

2. Spotting Fake Emails:

For more comprehensive information on this phone number scam, consider visiting 01903768600 to access a variety of opinions and feedback.

In this interconnected world, scammers often resort to sending deceptive emails to trick unwary customers. Beware of emails that appear to be from the Bank of Scotland, requesting personal information or urging urgent action. Remember, your bank will never ask you to disclose sensitive information or passwords via email. When in doubt, directly contact the bank using the official customer service number.

3. Unexpected Lottery Wins:

Bank of Scotland’s customers have encountered scams disguised as lottery wins. Scammers contact victims, informing them that they have won a substantial sum and, to claim their prize, they need to pay a small fee upfront. Remember that legitimate lotteries will not require payment in advance to receive your winnings. Stay cautious and report any suspicious encounters to your bank.

4. Phony Official Letters:

Fraudsters sometimes go the extra mile and send victims convincing letters posing as official correspondence from the Bank of Scotland. These letters may request personal information or claim that you need to update your account details. Always verify the legitimacy of such letters by contacting the bank using a trusted phone number or visiting a branch in person.

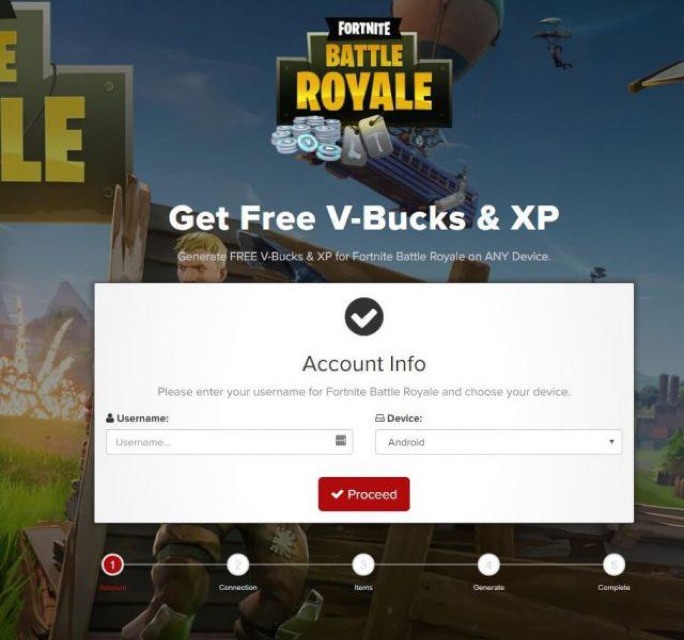

5. Unexpected Online Offers:

The internet can be a breeding ground for fraudsters, particularly when it comes to enticing online offers. Bank of Scotland customers have reported scams offering unbelievably low-interest loans or credit card deals. Remember, if an offer sounds too good to be true, it probably is. Always research the legitimacy of companies and deals independently before sharing your personal information.

6. Mobile Banking Fraud:

With the convenience of mobile banking, scammers may attempt to exploit security loopholes or trick customers into downloading malicious apps. Ensure you always download banking apps directly from official app stores. Be cautious of unsolicited calls or messages requesting your banking details, and report any suspicious activity to your bank immediately.

Conclusion:

Bank of Scotland scams are a prevalent form of fraud targeting unaware customers in the UK. By sharing real-life stories, examples, and practical tips and tricks, we hope to empower you to detect and avoid falling victim to these scams. Remember, a well-informed customer is the first line of defense against fraudulent activities. Stay vigilant, protect your personal information, and report any suspicious encounters to your bank promptly. Together, we can create a safer banking environment.